Hi, I'm trying to write a little every day until the end of the year. Today, I figured I'd talk about how I go through my household budget to try and get a feel for how we're doing against our (usually money-constrained) goals.

Before all that, let's take a moment to address that I think that there's a lot of unaddressed privilege wrapped up in financial advice. It's a fallacy to assume that it's possible to budget your way out of poverty. In the United States, there's a bit of unhelpful thought technology that equates and/or conflates financial outcomes with some sort of personal virtue. I intend on this being a way for someone who thinks that doing this is an burdensome chore instead of something one can knock out with an index card and maybe a bank statement in an hour. Worst-case, this can be done in the check-cash place too: but those places are not conductive to standing around in my experience.

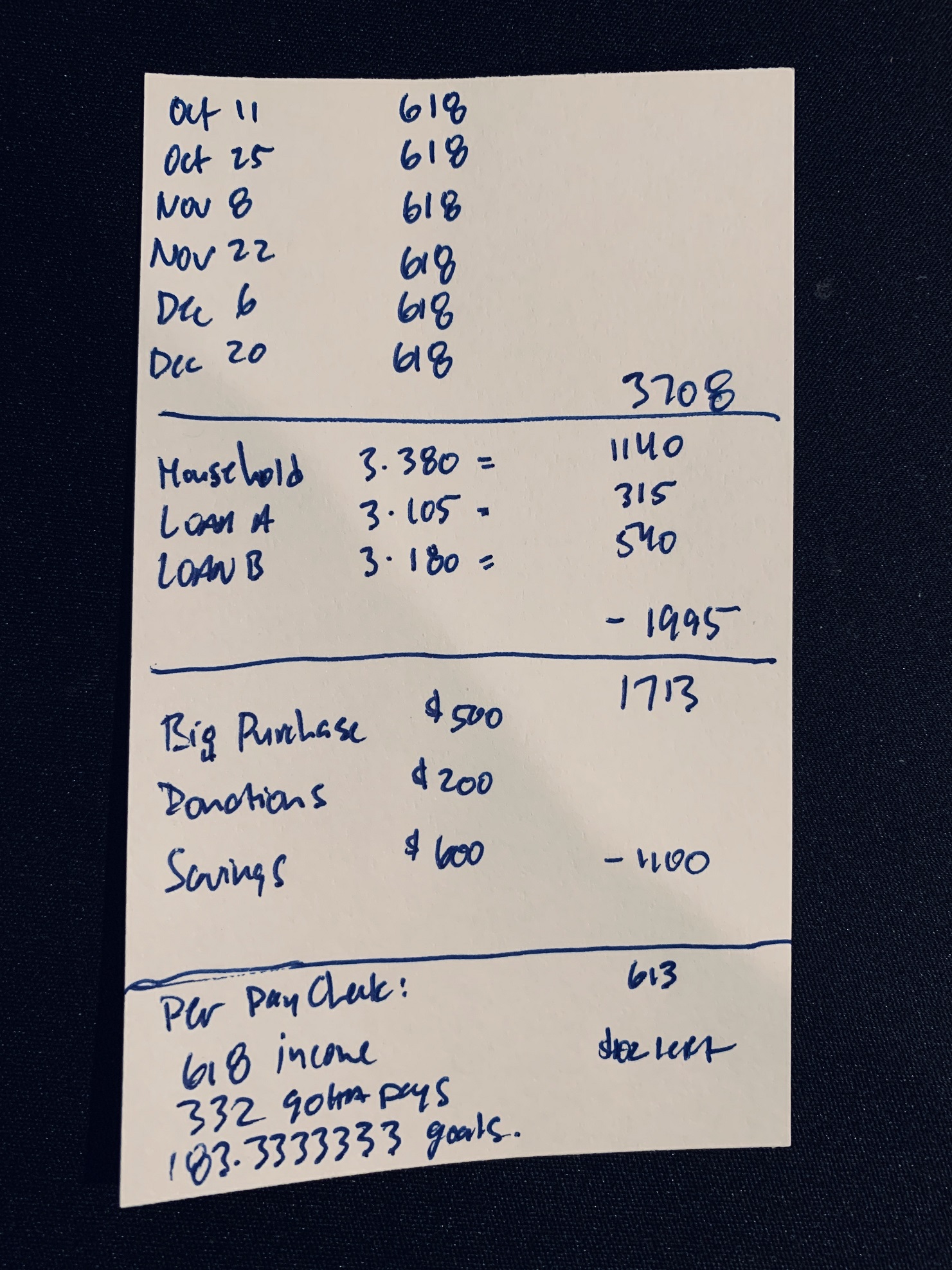

I usually pick an ARBITARY time frame: something like 10 paychecks (I get paid bi-weekly) or more recently, until the end of the year (I got six more until then). I also have a really good idea of what we'll call my "cost base". I lump all of the "cost of existing" bills into a household number and keep it moving. I do feel like I'm _geting away_ with having a consistent cost base and income since it REALLY simplifies things versus when I had a landlord that once forgot to pick rent for a month but then remembers after the month after.

Anyways, I do something like this:

- Count up all the money I'm expected to earn. This is a biweekly number.

- Add up my gotta-pays for that period. These are annoyingly monthly.

- Quantify my goals I wanna get done during this stretch of time.

- Figure out my income, gotta-pays, and goal number PER PAYCHECK.

- Every payday, see how you did against those goals, either toss the plan or fix the implementation.

Use those numbers each payday to see how well I did against the plan with the most recent paycheck. Instead of thinking about a bazillion categories or sub-headings or double-entry bookkeeping, check against your target number for each thing. This could take a whole additional index card if you have many transactions. I’m not super fond of the Target brand ones but they are under a dollar. I like to “zero out” my account my paycheck goes into after the next one shows up: that way, I’m never looking at more than a half month’s of income at once.

You’ll see by design this process isn’t made to account for every last dollar - not only is it really hard to guess how many unplanned expenses you have, maybe you only want to keep track of the first $x you make and leave the rest to an unplanned/untracked process. That is a thing you can do.

That’s kind of it. It’s a low-complication process by design, since, well, that’s how I like my systems.

Couple of quick hits around this process:

- Take a rolling average of the bucks you’re bringing in if you have a variable income.

- Even if you’re bummed at the numbers, they’re better to know than not know. We’ve all had down days, weeks, month, decades, whatever. I’d rather be specifically bummed at an actual gain/loss than generally bummed knowing it wasn’t a positive number.

- This index card can fit into your wallet or left laying around somewhere obvious for you to keep in the back of your head.

- And, by the way, this is why I find it so valuable: I think two weeks at a time, in big chunky categories, and never at the giant, towering goals that will take my months or years to address. Working on bricks, not walls, not multistory buildings.

- The other part that’s valuable is that you’re committing to thinking about it a little very two weeks. Not constantly unproductively, or never unproductively.